This article is no longer updated.

Please go to our new Intercom knowledge base to ensure you're seeing the most recent version.

The link above takes you directly to the equivalent article on Intercom.

If you record attendance in Music Monitor, you can use an inbuilt script to calculate any adjustments to student billing that may be required due to cancelled lessons or extra lessons.

NOTE: this calculates adjustments at the end of a period, after billing was applied in advance. If instead you bill in arrears, based on the lessons given, see Billing Tuition in Arrears.

Process Notes

Before you reconcile billing amounts, the attendance rolls must be complete for all teachers. If the rolls are not complete, your reconciliation will be inaccurate.

Ideally reconciliation should be conducted before the billing procedures for the next billing period. However, you must not reset Number of Lessons RP until after reconciliation has been conducted.

Run the Script

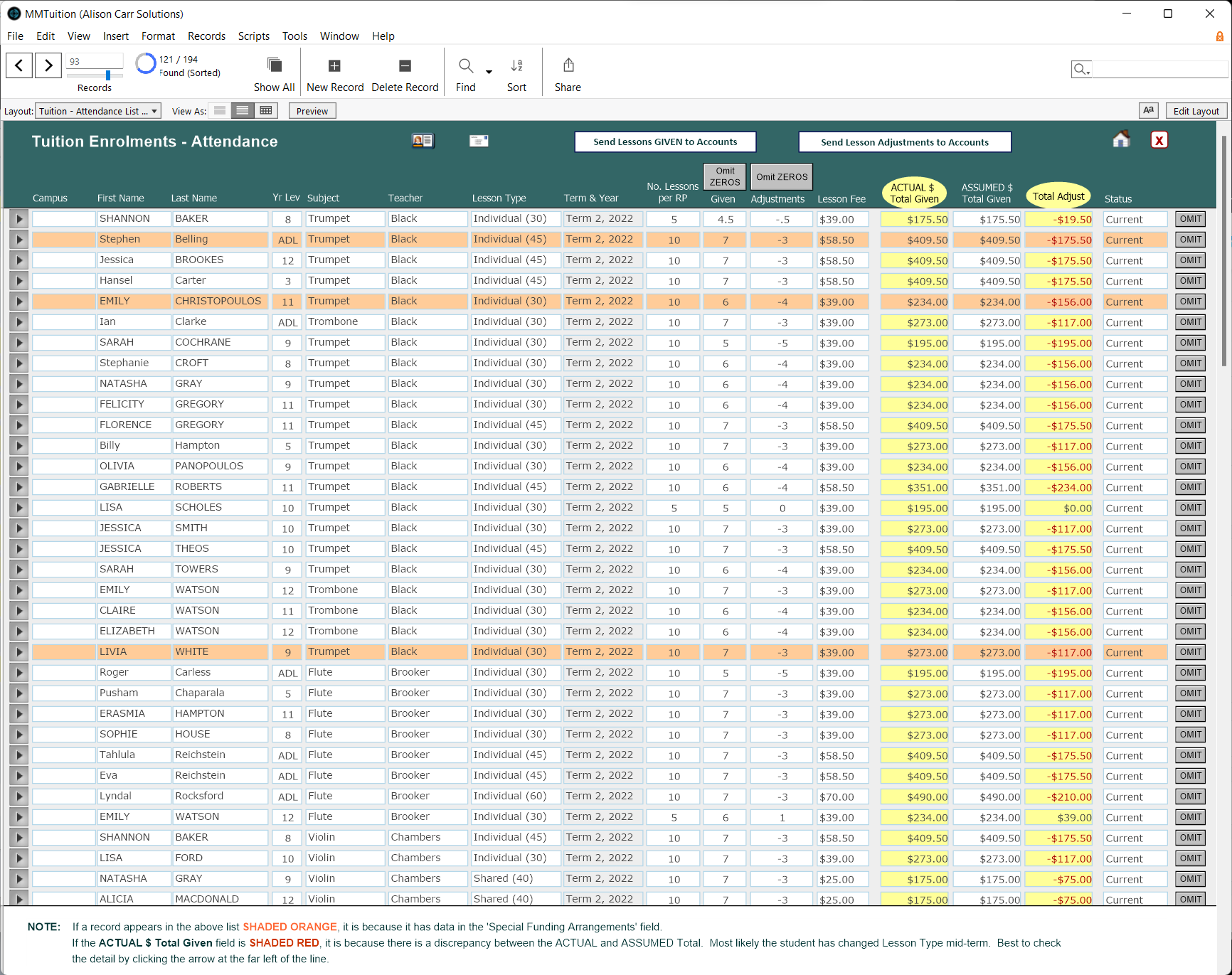

To begin reconciliation, go to Common Tasks > Billing > Send Lesson Adjustments to Accounts File. Follow the prompts to select the year, semester or term you wish to process. The script will then display the tuition enrolments that have marked attendance records in that time period.

Details of the tuition enrolments are listed in the leftmost columns.

The attendance records for the enrolment can be viewed via the play button icon at the far left of the row - if needed, you can actually edit the attendance records from this view.

The columns to the right of the screen calculate the value of lessons billed, lessons given and therefore the required adjustment. This will show credits required for lessons not delivered, and also additional charges for lessons delivered beyond what were billed.

Notes:

- Most columns will sort when the header is clicked.

- Archived tuition enrolments will be shaded yellow.

- Records shaded orange have something in Special Funding Arrangements. These enrolments should be manually checked, as if a scholarship or bursary was applied during the billing period it may be inappropriate to award a lesson credit.

- Records are shaded red when Actual Total Given and Assumed Total Given differ. This usually occurs when a change of lesson type took place during the reconciliation period. Total Adjust should be manually verified for these records.

- Omit Zeroes can be used to omit records with Given or Adjustments of zero.

Scrutinise the numbers on this screen carefully. Where there is a problem, the cause is usually the accuracy of the attendance records or Number of Lessons RP.

Sort the records by various columns and look for anomalies and errors. When checking, pay particular attention to:

- Adjustments is the number of lessons the tool has calculated to be credited or debited. Records with large numbers in Adjustments should always be examined.

- Number of Lessons RP is manually entered and should equal the number of lessons the student was charged for the reconciliation period. Where a large Adjustments has been calculated, the Number of Lessons RP is often incorrect. Check the Accounts Tab in the Student File to verify the number.

- Given is the number of lessons the student should pay for according to the rolls. The maths for this number is always accurate, so where the number is suspect the attendance records should be checked for incorrect attendance marks, double entry or other problems.

- Lesson Fee is the fee according to the tuition enrolment.

- Total Adjust is Lesson Fee multiplied by Adjustments.

- Red and orange highlights indicate a possible conflict with lesson fees and a special funding arrangement respectively. These should be checked manually.

Once you have checked and verified the numbers, select the Send Lessons Adjustments to Accounts button. Follow the prompts to complete the import into the Student Accounts file.

The imported line items will then be displayed for review. If there is an error, you can manually edit or delete a line item, or even safely delete the found set and start the process again.