This article is no longer updated.

Please go to our new Intercom knowledge base to ensure you're seeing the most recent version.

The link above takes you directly to the equivalent article on Intercom.

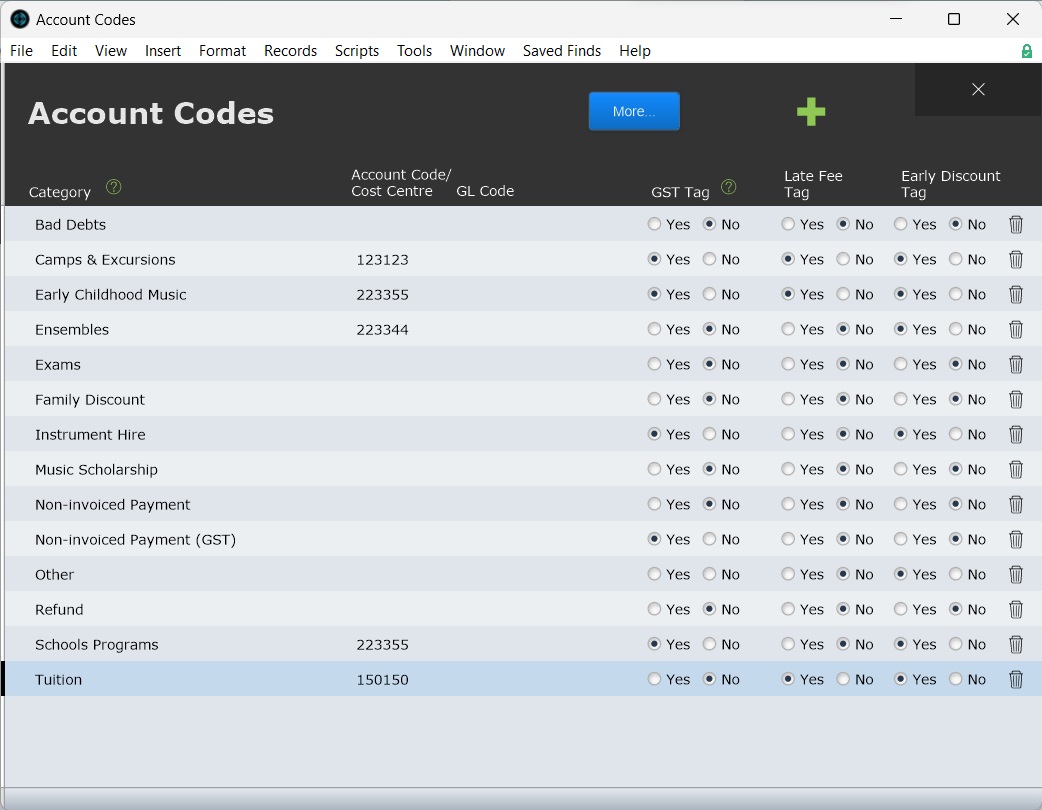

Navigate to Account Codes

From the Home Menu to go Setup Files > Account Codes.

Add an Account Code

All codes need Category filled; all other fields are optional.

Account Code / Cost Centre is the primary code associated with the category. This will appear on reports and extracts.

GL Code is a secondary code associated with the category. This is intended to be used to help your accounts office match these items with the GL codes used in your accounting system. It will appear rarely on reports and extracts but you can include it in any custom export you make.

GST Tag will apply GST to the category when Music Monitor is used for invoicing. This field is included in the Save as Xero CSV extract.

Early Discount Tag and Late Fee Tag are used only when Music Monitor is used for invoicing. It applies early and late payment discounts and fees.

Special Account Codes

Account codes with the Category set to "Refunds", "Non-invoiced Payment", "Non-invoiced Payment GST", and "Music Sundries", each have special behaviour.

Miscellaneous fees with Account Category "Music Sundries" will be available to teachers to add to student accounts. Teachers can add charges from the Attendance Form View. They can only add charges using miscellaneous fees with the Account Category "Music Sundries".

The Account Category "Refunds" is used in the write off or refund credit balances process. See Write Off or Refund Credit Balances.

"Non-invoiced Payment" and "Non-invoiced Payment GST" are used for payments received for services or items that don’t require an invoice to be produced. See Non-Invoiced Payments.

Edit or Delete Account Codes

Account Codes can be edited or deleted at any time. All changes will only effect accounts line items generated after the change is made.